The weighted cost average method is used to calculate the average cost of purchasing or production of an inventory item.

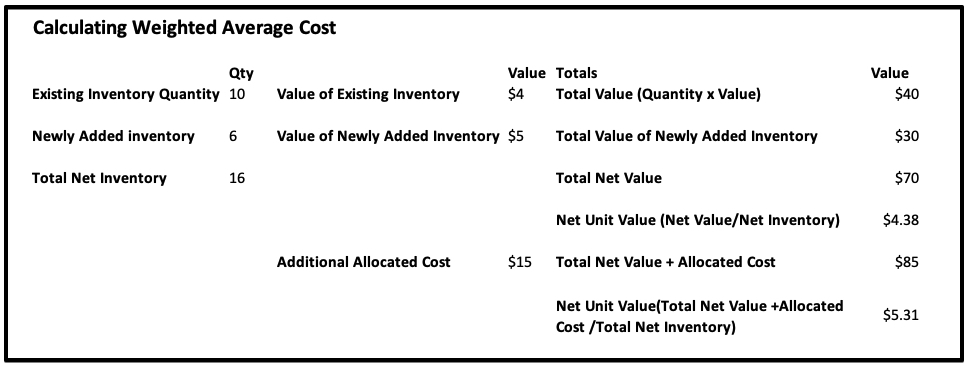

When using the weighted cost average method, divide the sum of total net value of goods available for sale and the allocated costs by the total net quantity of inventory available for sale, which yields the weighted-average cost per unit. In this calculation, the total net value of goods available for sale is the sum of beginning inventory quantity and net purchases. You then use this weighted-average figure to assign a cost to both ending inventory and the cost of goods sold.

The net result of using weighted average costing is that the recorded amount of inventory on hand represents a value somewhere between the oldest and newest units purchased into stock. Similarly, the cost of goods sold will reflect a cost somewhere between that of the oldest and newest units that were sold during the period.

Another way of describing this formula:

You have 10 units in stock, valued at $4 each, so the total value is $40.

You add 6 more units, which cost more at $5 each

The total value you are adding is $30

After this addition you will have a total of 16 units in stock, valued at $70.

$70 divided by 16 (the average) is $4.38

Inserted 3/24/20 by SH

Modified 4/27/20 by AG

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS