This year the government has implemented the first major changes in tax withholding in 30 years. In order to insure accuracy, we are recommending that you have your employees fill out a new W-4 for 2020 as there have been new sections added and some sections removed.

New W-4 for 2020 (Download here)

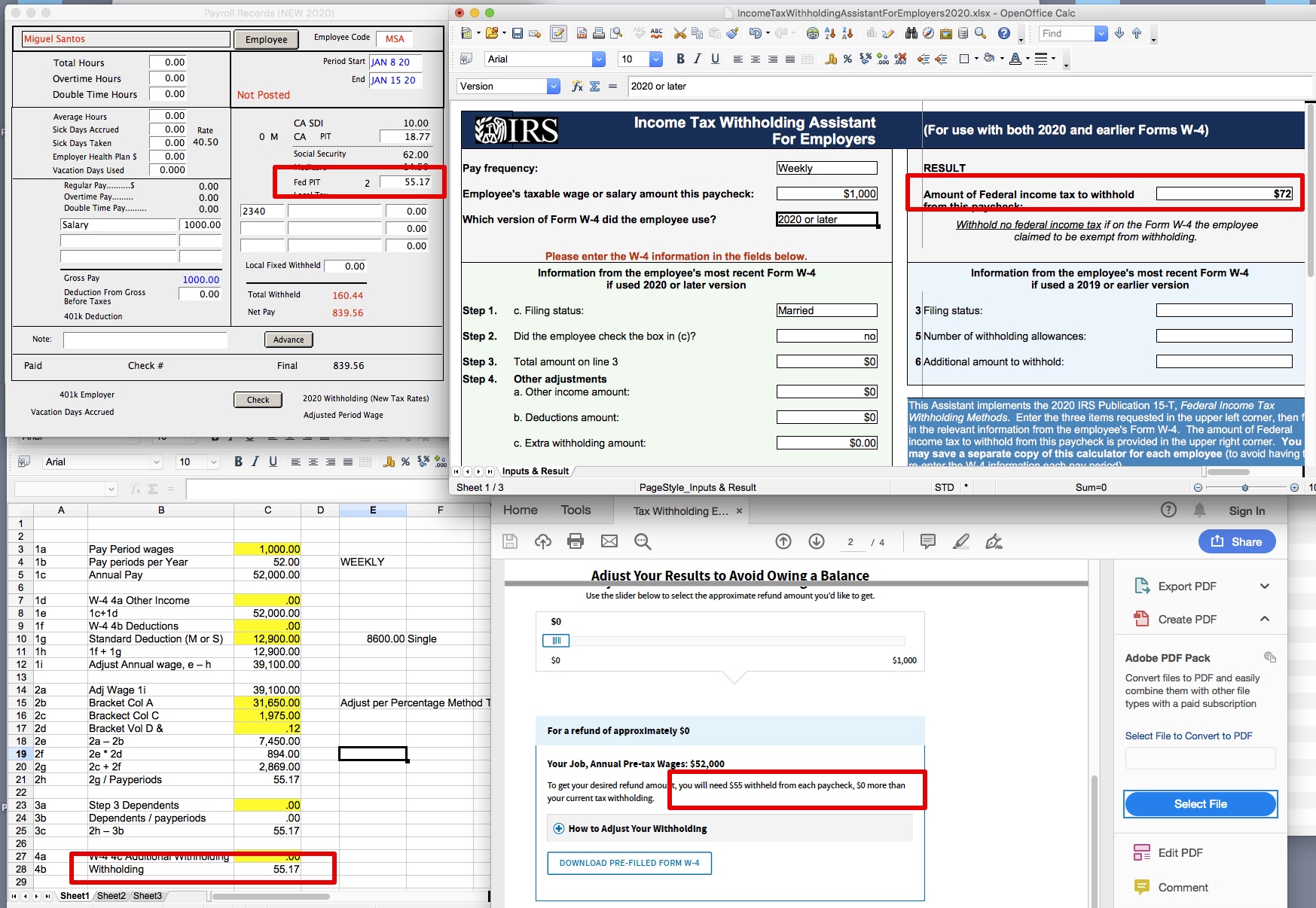

Note: If an employee checks the box on 2.C. of the W-4 for 2020, you will need to calculate Federal PIT using the spreadsheet provided by the IRS below or the online tax estimator.

Income Tax Withholding Assistant For Employers 2020 from IRS (Download Here)

IRS Online Tax Estimator (Click to access)

We detected discrepancies between the governments calculations and our own and other tax calculators.

Since the IRS calculations have been inconsistent, we cannot be responsible for accurate reporting.

Our recommendation is that each employee and/or employer use the Online Estimator, now, or perhaps sometime in February or March. It can be used partway through the year to adjust withholding.

These screenshots display the discrepancies we detected in a very simple situation.

Inserted on 1/9/20 by SH

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS