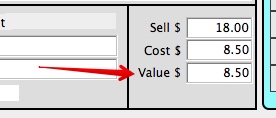

For both finished Inventory and Raw Materials, there are 3 price fields:

Cost

Value

Purchase Price or Vendor Price

Inventory Style Master window:

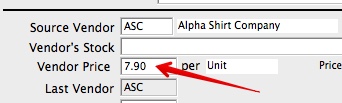

Inventory Style Purchasing window:

Supporting both Cost and Value is a standard accounting feature.

The Cost field records your actual cost, which usually includes the incoming freight to land it in your warehouse.

The Value field is usually your cost, but can be less. If the goods have been damaged, or devalued due to their becoming obsolete, the value can be made less than the cost. For example, last year’s fabric may be worth less than you paid for it because the color is no longer in fashion. This is know as “Lower of Cost or Market”.

The Purchase or Vendor Price field is the price you will pay the vendor, before any shipping charges are added.

This field is used for default amounts for entry of Purchase Orders.

The Value is the most important number!

This number used to calculate the Cost of Goods Sold, and is also used for valuing inventory for tax purposes.

The value field is stored in the invoice line item at the time of clicking OK on the invoice insert.

Inventory > Preferences > Tab pane Costing > #2

You can enter a percent number that will be used to calculate the cost as a percentage of the sell price. This will allow a rough cost value to be automatically entered during setup, before the detailed costs are calculated.

Revised by AG, 12-8-19

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS