Sales tax can be set up for an entire state. The process is done within the County Tax Rate fields.

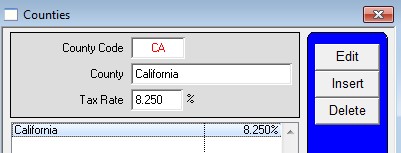

Maintenance > User Lists > Group 2 > County Tax Rates

Insert the state abbreviation in the County Code field.

Enter the state name in the County field.

Enter the tax percentage in the Tax Rate field.

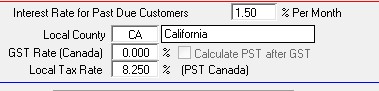

Next, go to Menus > Maintenance > Company Information

Enter the state abbreviation in the Local County field.

Enter the tax percentage in the Local Tax Rate

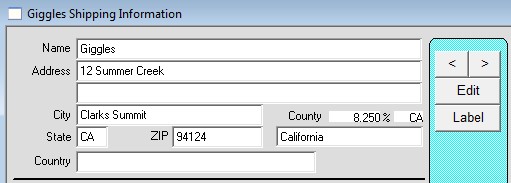

Lastly, assign taxable customers to a state on the shipping window via Menus > Customers > Shipping.

Note that tax assignment can be changed on the Order window, but not on the Invoice window.

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS