In the past if you charged a customer sales tax, and later the customer submitted a resale card, it was difficult to enter a sales credit for the tax amount only.

This new method of refunding the sales tax is easier and more efficient.

New method:

1)

Insert an inventory item in the Stylemaster and name the item “TAX ADJUST”. Leave the dollar values at “$0.00” and do not enter quantities of stock.

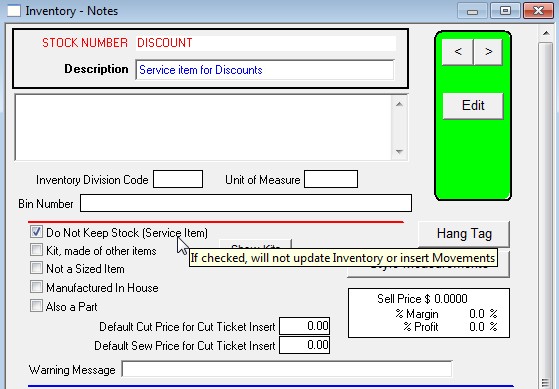

After you have inserted the TAX ADJUST item press the Other Data menu in the top left of the Stylemaster and select Notes.

In the Notes window click Edit and place a check in the box for “Do not keep stock (Service Item)”. Then press OK.

2)

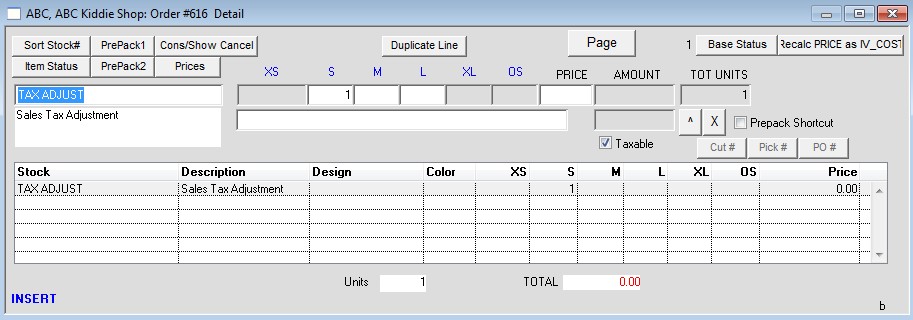

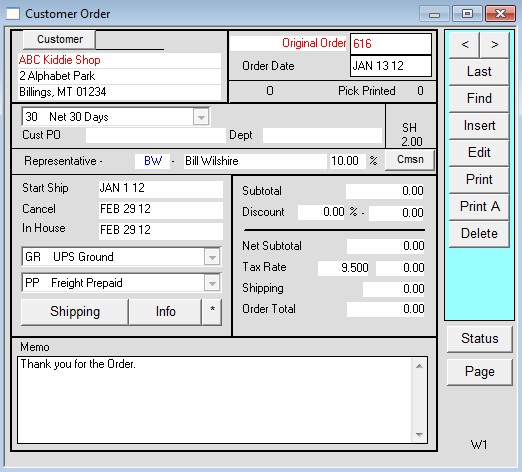

Insert an order and enter the Sales Tax item you created in Step 1 with a quantity of 1 and leave the price blank.

Enter the correct Sales Tax Rate on the front of the order. When done press OK.

3)

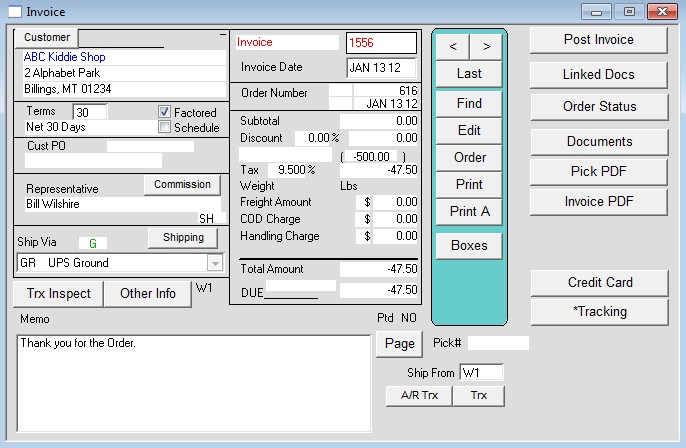

Invoice the order and Ship All. When you press OK to you will receive a prompt stating the total is “0.00”. Press OK to the prompt. Do NOT post the invoice yet.

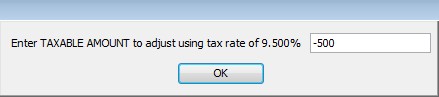

Now press the Other Info button. In this window press the “Tax Adjust” button. You will be prompted to enter the taxable amount to adjust using the tax rate you initially entered on the order.

Enter the taxable amount (using a negative number) and press OK.

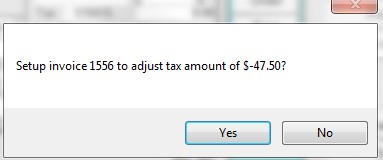

Press Yes when prompted to adjust the invoice tax amount.

4)

The invoice will show a refund for the amount of the sales tax and can now be posted if desired.

Notes:

The Tax Adjust button will be only enabled if the invoice is not posted and the subtotal is zero.

If the tax adjustment is entered wrong, it can be done again before the invoice is posted.

For versions of Perfect Fit released BEFORE Jan 1 2012 use the information at this link:

Refunding Sales Tax – Old

Revised 2/26/2015 – SV

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS