To get started with the Payroll module there are several steps which are:

1. Setup of tax rates via Payroll > Maintenance > Mnt

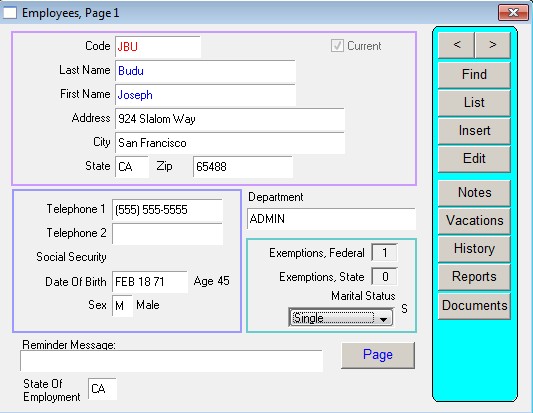

2. Insertion of employees via Payroll > Employees

3. Insertion of current payroll and posting it via Payroll > Payroll Records.

If you are not starting on Jan 1st then you must insert historical data, by quarter, and post after each quarter.

This is after step 2 and before step 3.

If step 4 applies to you, meaning you start payroll after the first of the year, you will need to do the following:

-Add up all payroll and taxes from your old system for payroll PAID in January.

-Insert ONE payroll record per employee for the month of January.

-Override the Income Tax numbers if they are different than the PF calculations

-Transactions > Pay Fed and State Taxes; enter the amounts actually paid.

Repeat for each month until payroll is current.

Tax calculations are dependent upon Year-To Date figures, so historical data must be entered before entering current payroll.

Revised 11/2/2016 – SV

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS