Paypal Accounting

This article uses Paypal as an example, however, you can use any type of account.

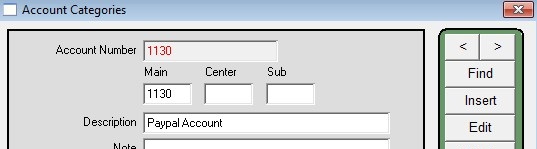

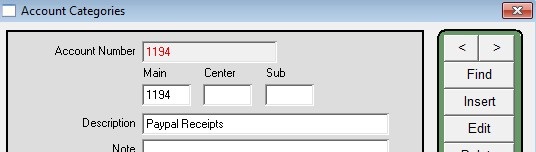

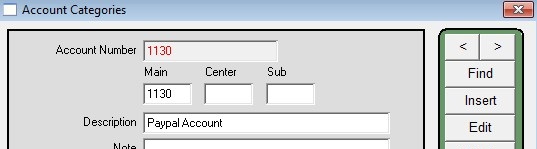

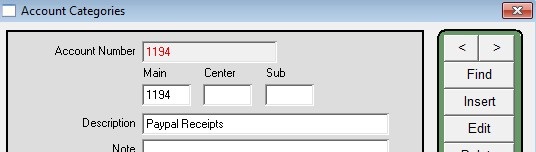

1) Insert Two Ledger Accounts

Menus > Ledger – Insert

- Insert the first account with the description as “Paypal” with the account number 1130 (you can use any asset account but we recommend using an account number that’s near 1100)

- Insert the second account with the description as “Paypal Receipts” with the account number 1194 (you can use any asset account but we recommend using an account number that’s near 1190

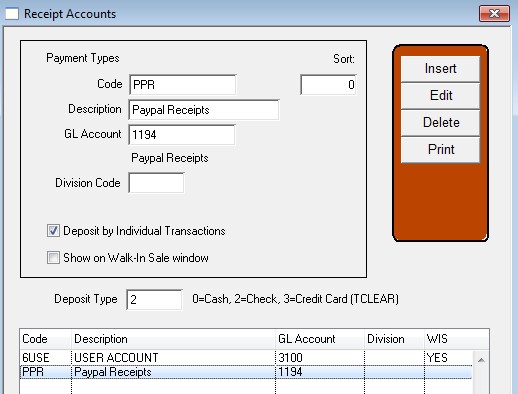

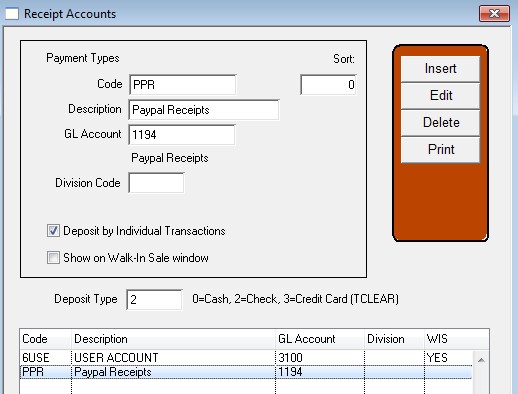

2) Insert A Receipt Account

Menus > Maintenance

Maintenance > User Lists > Group 2 > Receipt Accounts – New

- Insert an account for the Paypal Receipts account you created in step 1. Use the same ledger account (in this example account 1194).

- Place a check in the box “Deposit by Individual Transactions”.

- Place a number 2 in the “Deposit Type” field.

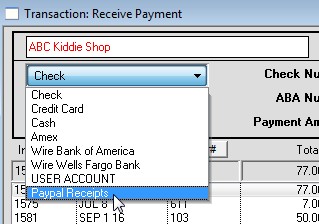

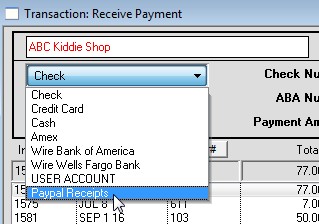

3) Receive Payment On An Invoice

Menus > Invoices > Commands Receive Payment

- Select the Paypal Receipts account from the dropdown in the top left and receive the payment.

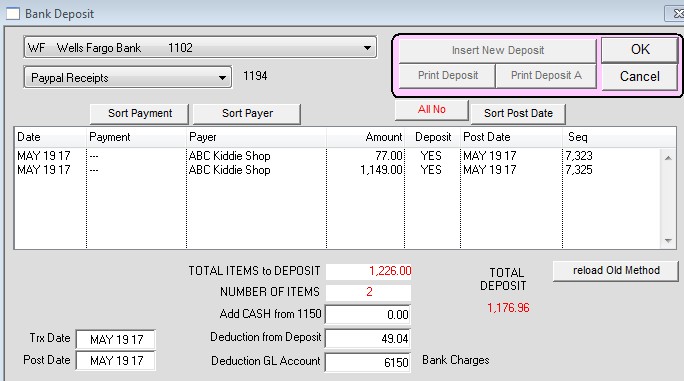

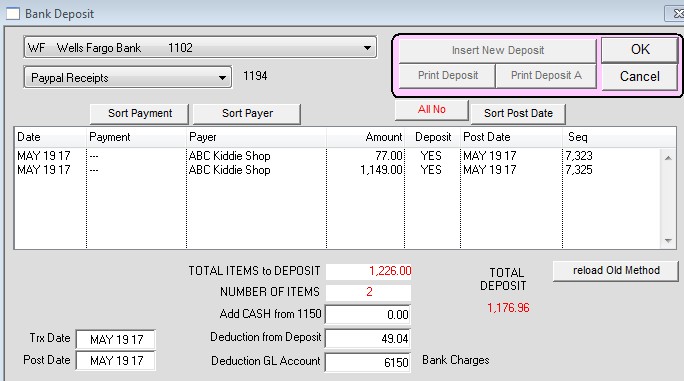

4) Deposit The Money

Commands > Bank Deposit

- Select the Paypal Receipts account from the dropdown menu in the top left

- Click the “All Yes” button to set all lines for deposit (or select each line manually)

- Enter the Paypal deduction in the “Deduction from Deposit” button. For example, a 4% fee that Paypal charges

- Enter the GL account you use for bank charges (By default it is 6150)

- Press the OK button to process the deposit