This example shows how to do a Month End Inventory Reconciliation for Finished Goods.

The same principle applies for reconciling Raw Materials.

It will adjust the Financial Statements Trial Balance and Balance Sheet to match exactly the value of inventory as reported in PERFECT FIT.

This process is most accurate and best done on the first day of each month, or as soon thereafter as possible.

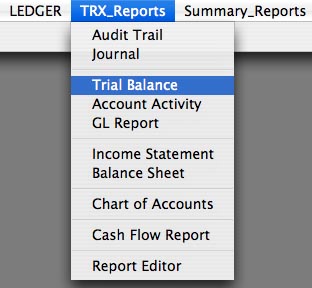

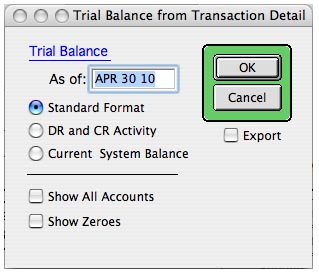

1) Print the Trial Balance Report under Ledger > TRX Reports, for the last day of the previous month:

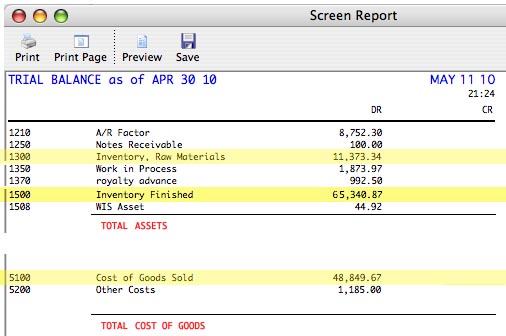

2) Highlight (yellow marker on paper) the 3 lines of interest:

Raw Materials Inventory

Finished Goods Inventory

Cost of Goods Sold

Note: This is a simple example, however this principle can be used to reconcile multiple inventory accounts.

Inventory Pending: If you are using the pending accounts, they hold the values of Inventory received that is not vouchered, that is, you have not yet entered a payable for it. Since the inventory quantity is updated in real time, you should not move this number into finished inventory. You should check to see that the pending amount makes sense. If not, make an adjustment against Cost of Goods Sold or perhaps one of the Equity accounts. You may need to discuss this adjustment with your accountant.

Pending amounts can be difficult to track. A strict method would be to make sure that when ANY items or materials are received, a receiving slip makes its way to the A/P department. In A/P, these slips should be matched to vendors bills as they come in. The pending amount at the end of the month is the total of all receiving slips that do not yet have payables attached.

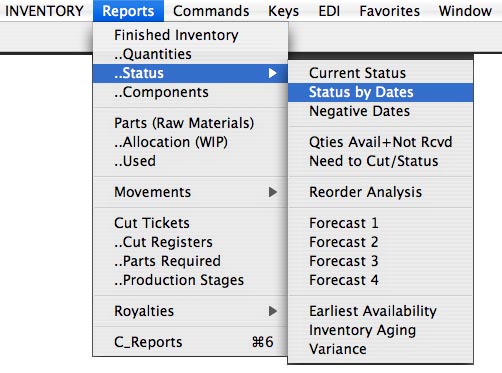

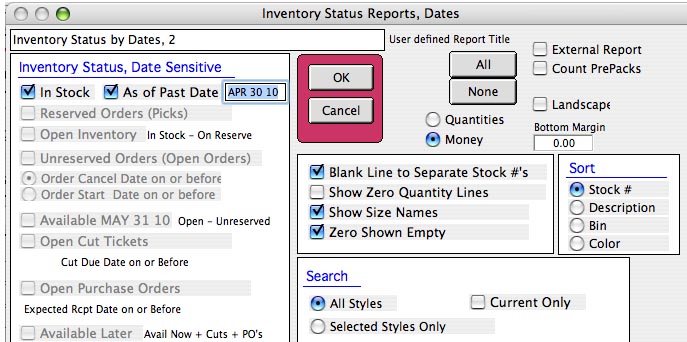

3) Print the Inventory Status Report

Inventory > Reports > Status > Status By Dates

Note that if you print this on the first of the month, you can use the Current Status report.

4) See the settings below.

You must Search ALL Styles, and do nott check the Current Only Option

Select the Money Report.

You may want to print this to file or PDF, as it can be very long.

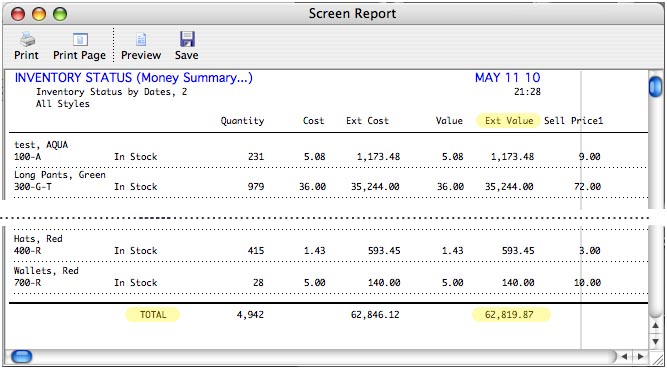

5) Review the report to make sure your numbers make sense. If you see large values, confirm that they are reasonable. If you need to make changes, you can Adjust the Quantities in Stock, or adjust the Value/Cost, and run this report again.

If you are using Real Time Costing, you must run the Trial Balance again also.

The Number highlighted below, Inventory Extended Value, is the one we want.

6) Calculate the adjustments that need to be made to the ledger Trial Balance.

The Accountant’s Bible can help us figure this out.

In this example, note that the Inventory report is LESS than the Trial Balance, by $2,521.00

Since the Accountant’s Bible tells us that ASSETS (Inventory) must be CREDITED to REDUCE their value, we set up a “T Diagram” to show a Credit on the side of Account 1500.

Since the Inventory has been reduced, it must have gone to sales (hopefully not stolen!), so the other side of the transaction will be to Cost of Goods Sold. A Credit on one side means the other transaction in the set must be a Debit, so we make a second T Diagram like this:

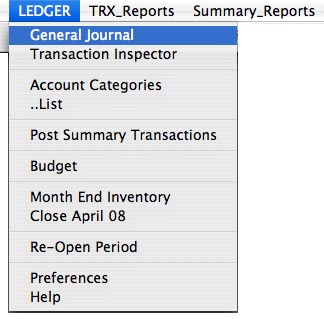

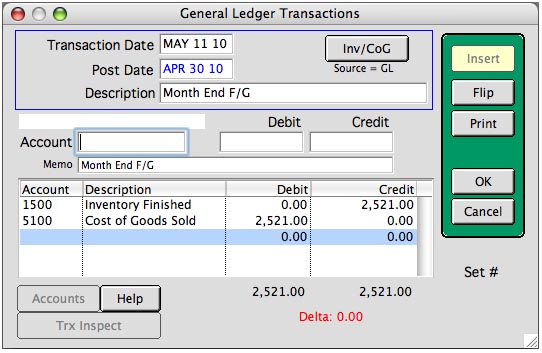

7) Use the Ledger > General Journal to enter the transactions.

8) This shows the entry for our example.

Notice the Post Date is the last day of the previous month.

Click OK to save the entry.

9) Print the Trial Balance again to prove that the Ledger Balance matches the Inventory Value.

10) Close the previous month (Ledger > Close Periods) as soon as you can after making this entry to prevent users from backdating invoices, inventory movements and adjustments.

Raw Materials can be processed the same way.

We are not supposed to give accounting advice, so if you have questions as to what account numbers to use and how to deal with more complex situations, please refer to your accountant. Our training is limited to the use of the software.

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS