Foreign Currency 2

This wiki will show you how to sell items using a foreign currency using both GST and PST.

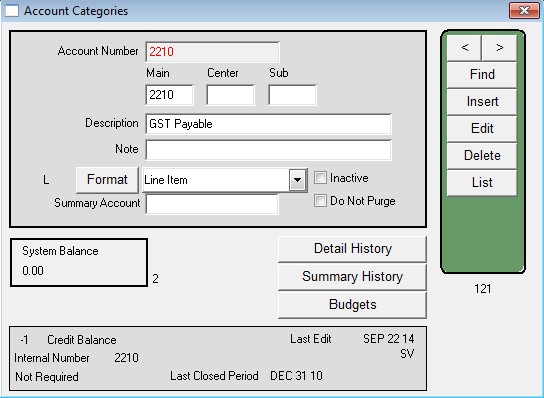

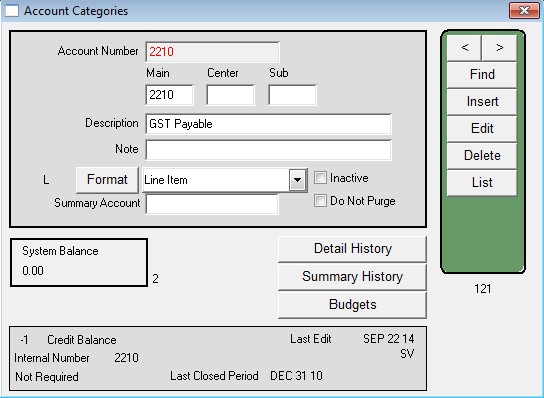

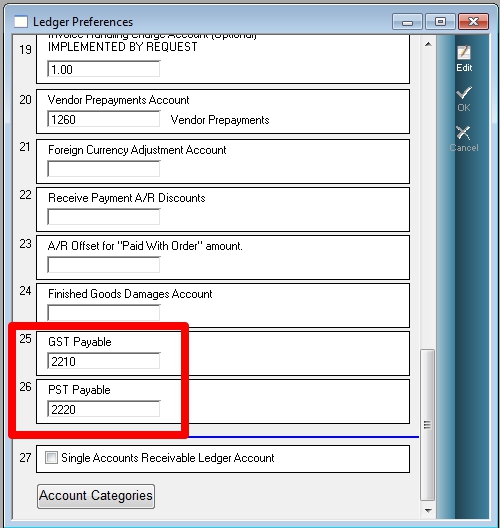

1) Insert Ledger accounts

- Menus > Ledger > Ledger > Account Categories

- Insert account 2210 (if it doesn’t exist already), with a description of GST Payable.

- Insert account 2220 ( if it doesn’t exist already) with a description of PST Payable.

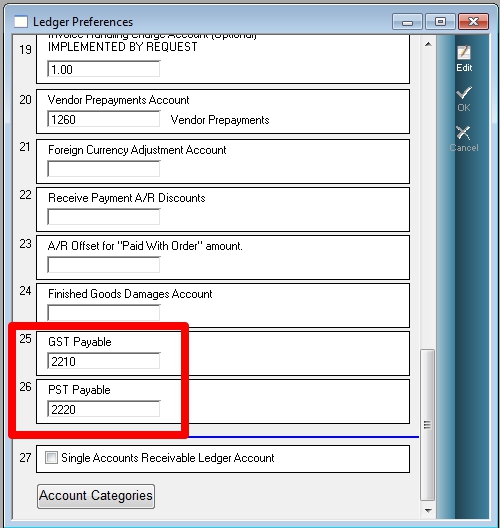

2) Ledger Preferences

Maintenance > Preferences > Ledger

Enter the 2 accounts near the bottom of the window.

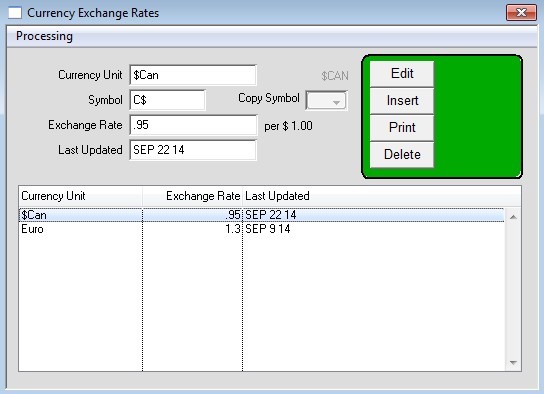

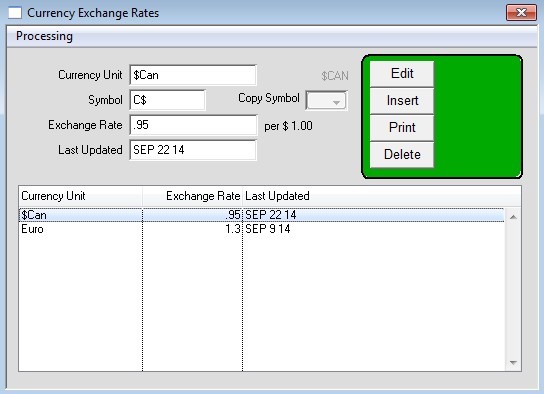

3) Insert or Edit Currency

- Menus > Maintenance > Maintenance > Users Lists > Group 2 > Currency

- Verify that the Canadian currency exists, with a Currency unit of $Can and Symbol of C$. If they do not

already exist, insert them.

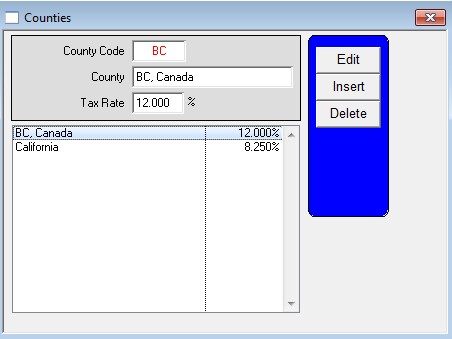

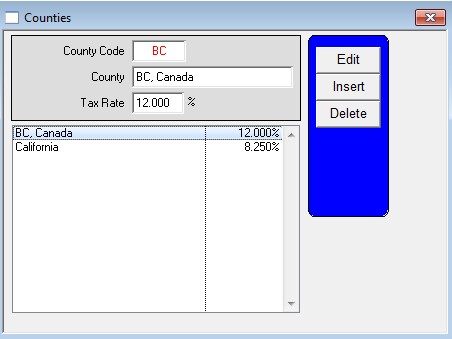

4) Insert County Tax Rate

- Menus > Maintenance > Maintenance > Users Lists > Group 2 > County Tax Rate

- Enter the desired code and county name.

NOTE: THE TAX RATE MUST BE THE TOTAL OF GST AND PST.

In this example we are assume GST is 7% and PST is 5%, so the total is 12%. Thus, you would

enter 12% in the Tax Rate field.

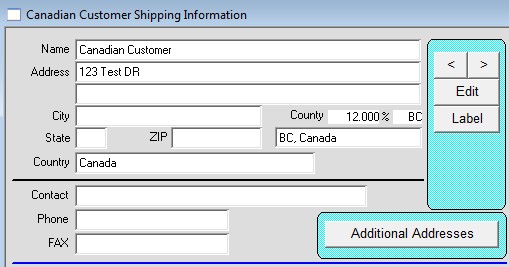

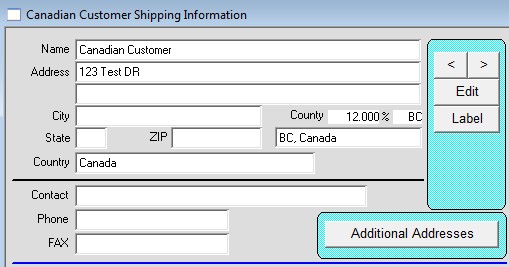

5) Enter the County Tax Rate in the Customer Shipping window

- Menus > Customer > Shipping

6) Enter the Foreign Currency name, and GST % in the Customer Prices window.

- Menus > Customer > Prices

- Click the Edit button next to the Price Level fields

- Enter the Foreign Currency UNIT in the Foreign Currency field

- Enter the GST amount, in this example 7%

- Place a check in the GST and PST Tax on Freight box.

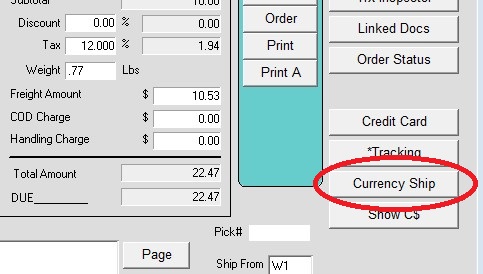

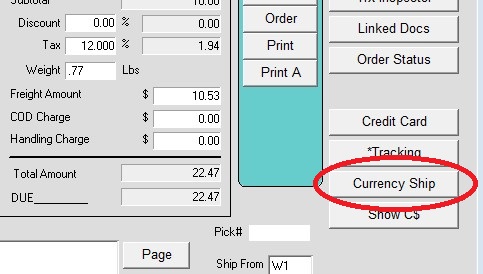

7) Insert an order then invoice it.

- Do not enter a freight amount. Instead, click the Currency Ship button on the invoice, and then enter the freight there, and press OK.

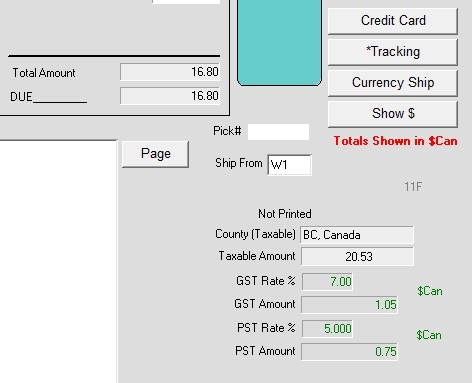

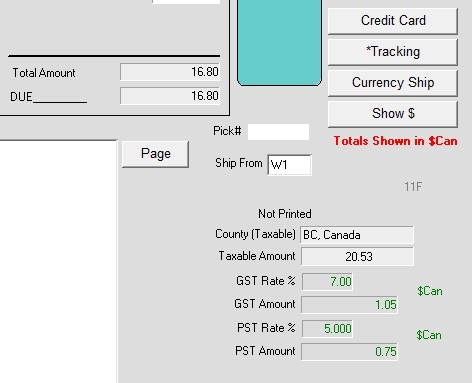

8) To see the amounts in Canadian $, click the Show C$ button.

Note – Foreign Currency with GST and PST is only supported in the PrintA function (Form Editor module).