End of year Payroll (not general year end procedures, although is recommended) must be run before entering payroll records for the new year. The government calculates all taxes based on the date the payroll check is written.

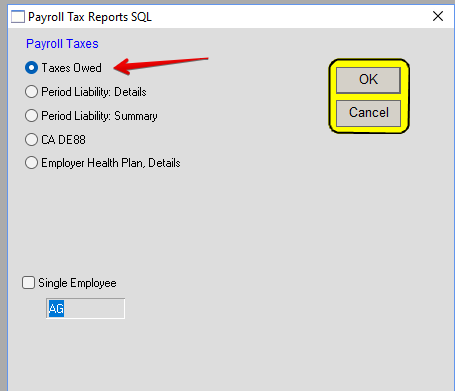

In January, before you enter any January payroll, you must pay ALL outstanding taxes for the previous year. Check to see if any taxes are owed: go to MenusSQL>Payroll > Reports >Taxes & Liabilities > Payroll Taxes Report SQL Click on Taxes Owed. Click OK.

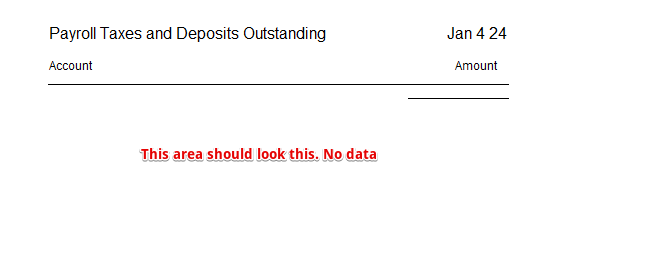

This report should show nothing.

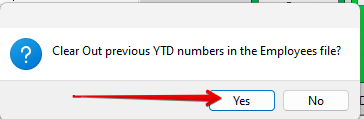

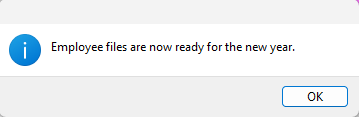

Go to Payroll > Maintenance > Mnt > Employee Year End Reset.

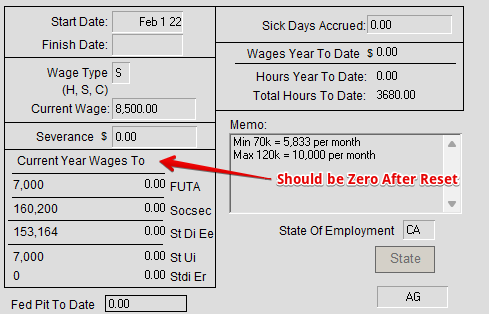

This will set all the Year-to-Date fields in the employees file to zero. This is very important, as some taxes are calculated based on this amount.

Check an employee record (PAYROLL > Employees > Find an employee and click page. Look above Red Line. Current wages must be zero.

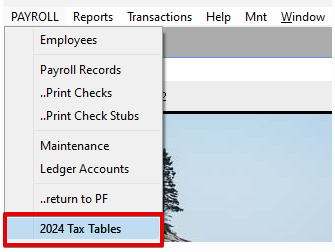

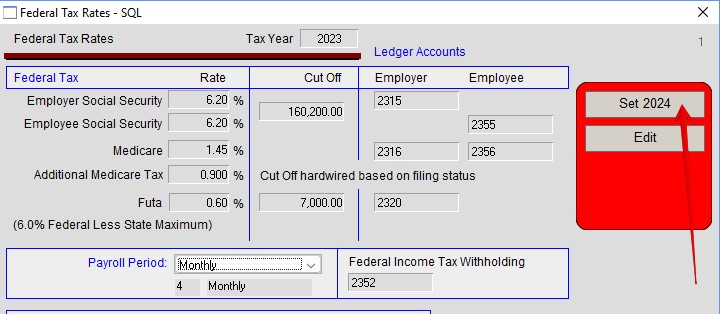

Check to make sure Tax Tables reflect the current Year (See Red Box below).

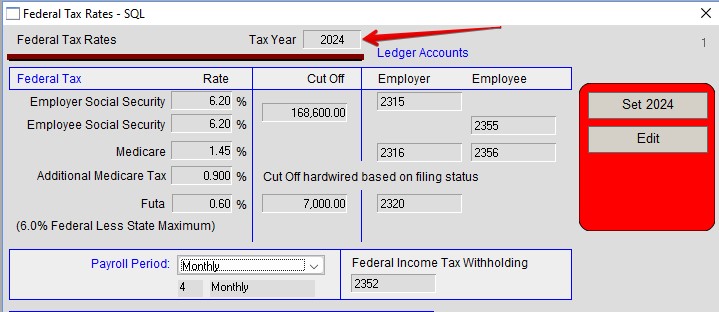

Go to Payroll > Maintenance > Mnt > Federal Tax Rates (Enter Federal first and then State taxes.) Click “Set 2xxx” (the year will reflect the current year) to change the TAX YEAR and the tax rates and the cutoff.

Click OK

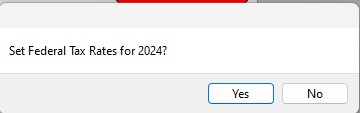

Click Yes

Click OK

Check to make sure you are in Current Tax Year (See Red Arrow Below)

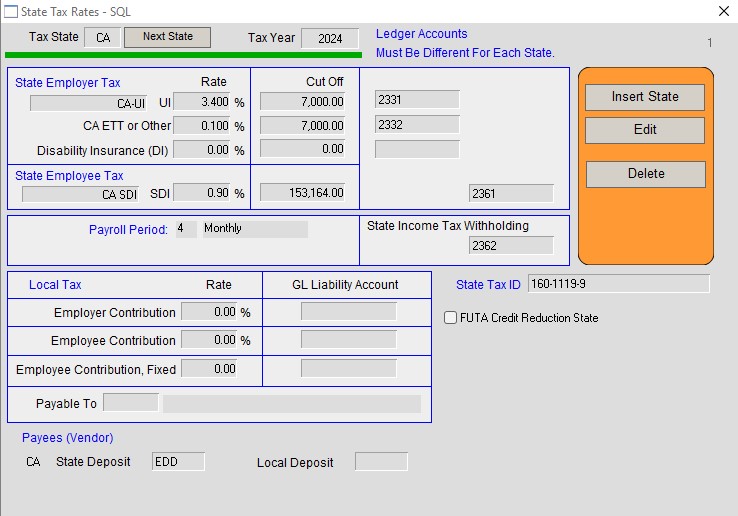

Go to Payroll > Maintenance > Mnt > State Tax Rates.

Click Edit (the year will have defaulted to current year)

DO NOT click INSERT, as that is for adding another STATE to the payroll system. When you hit TAB the standard rates and cutoffs will e filled out automatically.

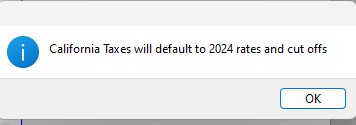

This is for California. If your state is Texas (or other state) than you will get Texas message.

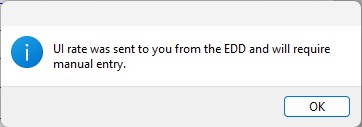

There may be some numbers that are specific to your company. These will need to be entered manually. (unemployment insurance (UI) Rates for one)

If there are numbers that are universal for all companies they will be updated automatically.

After the above steps are complete, you can enter new payroll records.

Version Upgrades: The Tax Tables that are stored in the PERFECT FIT library are the Income Tax Withholding Rates. All other taxes are set via user entry as described above. On the Payroll Record window this is designated as PIT, Personal Income Tax. These can be overwritten during data entry.

After upgrading to a new version, please examine the tax calculations for the first pay period. You can compare them to the government’s published tables or compare to last year to make sure they “make sense”. The income tax withholding calculation uses a mathematical formula, and thus will not match the pre-printed tax tables exactly, but they should be close.

-HS 1/8/24

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS