Method 1:

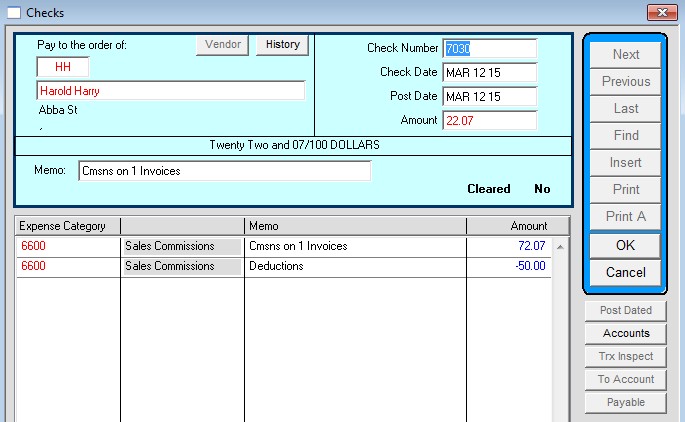

Pay commissions as usual, except when entering check, add one line under Expense Categories, and enter the negative amount you wish to deduct.

You will need to change the check total manually before clicking OK.

Method 2:

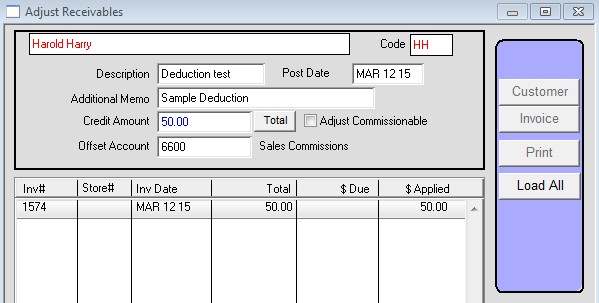

An invoice must be issued for the Rep’s samples, to the Rep. The Rep is entered as a “Customer”, with the Exact same code as on the Rep Window.

When Paying commissions, if you chose to “write the check now”, and if the Rep has open invoices, you will be asked if you want to deduct open invoices from the commissions. Answer Yes, and the check will be set up properly for the deductions. Click OK on the Check. If you cancel the check the Commissions will still be marked as paid. Do not cancel the check.

If The Reps Invoices are greater than the commissions being marked to pay, and you want to record the adjustments without writing a check, then answer yes to “write the check now”. The Other Credits to Invoices window will open. Enter the amounts to be equal to the commission amount, not the invoice due amount. Click OK. When the check window opens click Cancel. This will process the deductions.

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS