Real time Costing is turned on with General Preference #1

Weighted cost averaging is used.

Formula:

Here’s the scenario:

On Monday, you receive 10 items at a cost of $20 each, Total Cost of $200.

On Tuesday, you Invoice 8 of those items

Total cost is $160, and that gets record in the ledger.

The remaining 2 items in stock still show a cost of $20 each.

On Wednesday you receive a Freight Bill of $80 for the original 10 items.

Using the PO Allocate Costs button, you add this additional cost to what is in stock.

Since there are 2 remaining items, the In Stock Cost per item will now show $60 each

$40 original cost + $80 Freight divided by 2 items = $60 each.

Obviously the $60 overstates the individual cost, but since you sold (Invoiced) 8 items at BELOW Actual Cost, the 2 remaining items carry the higher cost in order to recover the excess freight cost.

The Actual Cost per item is $200 + $80 divided by 10 Units, = $28 each.

In the end, after all items are sold, this method comes out fine without further entry.

You can make an adjustment to show the Actual cost more accurately in the present, as follows.

This adjustment will recover the excess freight as a cost of goods sold entry, as well as reduce the Inventory In Stock Cost.

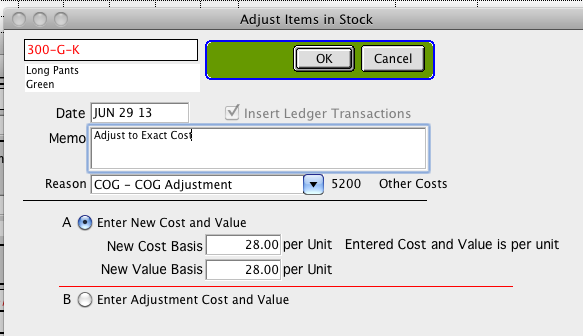

On the Inventory window, click the Adjust Cost/Value button.

Enter the New Cost and Value as your calculated Actual Cost ($28.00)

The Reason should be something like “COG Adjustment”, and should post to a Cost of Goods Sold Ledger Account.

The resulting transactions will show an increase in Cost of Goods and decrease in Inventory of $120,

and a second set of transactions will show a decrease in Cost of Goods and increase in Inventory of $56.

The net result is a decrease of Inventory value (from 60 to 28 each) and increase in COG of $64.

The Inventory now shows 2 items valued at $28, which is $16 more than the original cost of $20 each.

The adjusted Freight bill of $80 has now been divided between the $64 increase Cost of Goods adjustment (for items already sold)

and the $16 increase in inventory value for items remaining in stock.

Revised 5/10/17, SV

Copyright © AS Systems, All Rights Reserved | WordPress Development by WEBDOGS